Previous

Previous

May 15, 2025

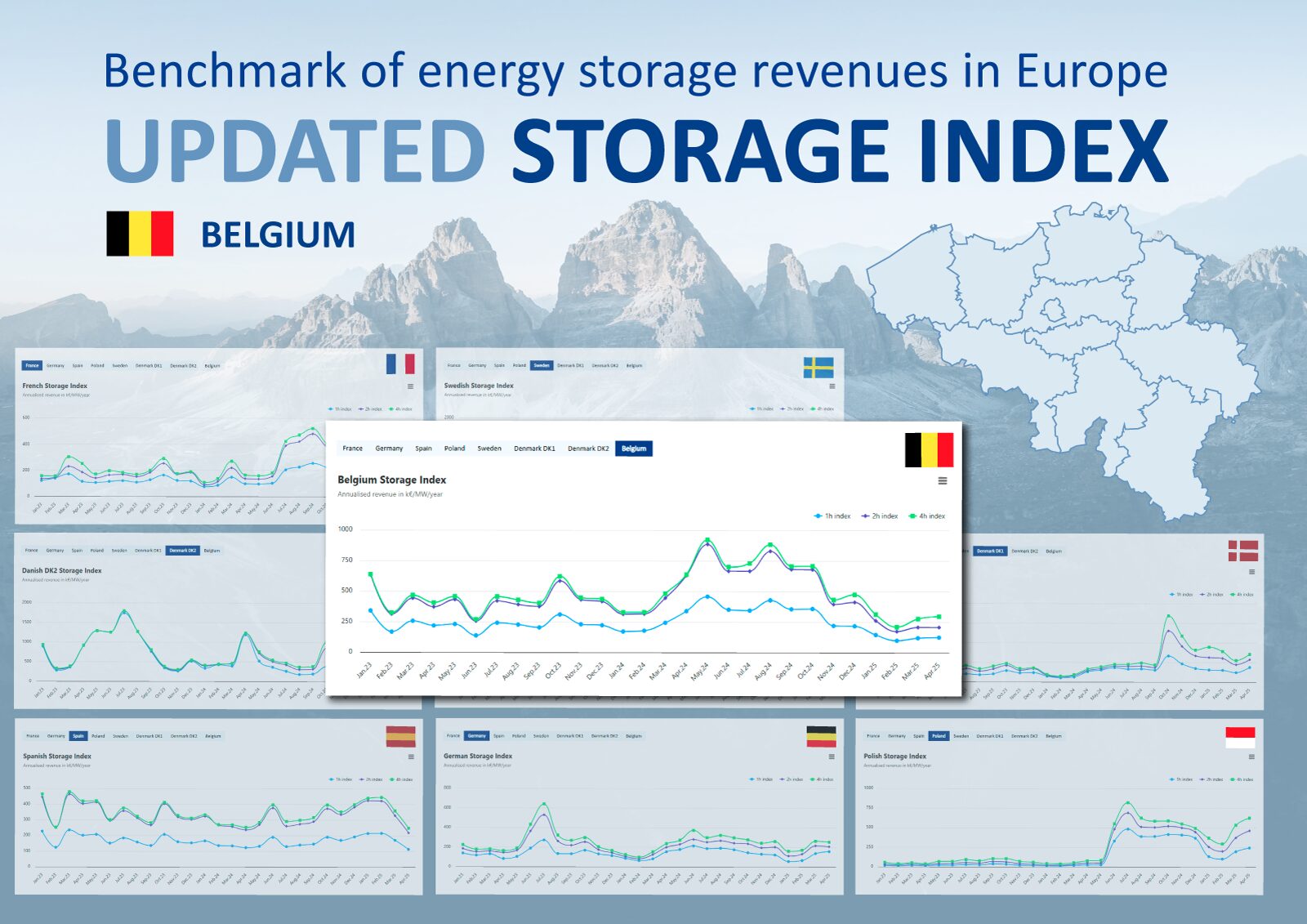

May 15, 2025 Clean Horizon has released the April 2025 edition of the Storage Index, offering the latest insights into battery energy storage performance across key European markets. As promised, we’ve added a new country – Belgium.

Below are key comments from Clean Horizon’s experts providing context and interpretation of this month’s Index results.

Storage Index Belgium:

This is the first edition of our revenue index for batteries operating in the Belgian markets.

November 2024 was a key turning point, as Belgium joined the PICASSO platform and new assets came online. Since then, market conditions have changed.

The impact of PICASSO has been clear in energy pricing: the spread in both aFRR energy and imbalance settlement has dropped from 800 €/MWh to 500 €/MWh. At the same time, increased competition from new assets has pushed aFRR capacity prices down:

• Upward capacity fell from 70.2 €/MW/h in Oct. 2024 to 10.5 €/MW/h in April 2025.

• Downward capacity dropped from 20.7 €/MW/h in Oct. 2024 to 6.2 €/MW/h in April 2025.

Battery revenues peaked at 750 k€/MW/y during Q2 and Q3 of 2024. Since then, the revenues declined in Q4 and have since stabilized at 200 k€/MW/y in 2025. These revenues are mainly driven by aFRR reservation and activation.

Storage Index Denmark:

DK1:

The increase in FCR revenues observed in March has improved the profitability of BESS projects in DK1. This notable rise offsets the decline in aFRR energy revenues, which results from market stabilisation.

DK2:

Batteries in DK2 are more exposed to the drop in aFRR energy revenues, as this decrease is only partially offset by moderate gains in FCR-N and FCR-D prices. Capacity prices for aFRR have also declined, which explains the lower revenues observed in April for battery projects in this zone.

Storage Index France:

April BESS revenues in France have almost doubled compared to March, driven by the continued growth of renewables, which is increasing the need for flexibility. This rising demand has led to higher prices in ancillary services. For instance, average aFRR Up and Down prices rose from 38 €/MW/h in March to 78 €/MW/h in April, while FCR prices increased from 39 to 45 €/MW/h.

This month also marked France’s entry into the PICASSO platform. Although it is still too early to draw firm conclusions about the opportunities for French assets on PICASSO, aFRR energy spreads are still promising.

Storage Index Germany:

April was marked by an increase in DA spreads in Germany due to lower DA prices during solar production. The aFRR reservation prices also show a high level, with several time slots where marginal prices exceeded 40 €/MW/h. These trends translate into high revenues for BESS in April.

Storage Index Spain:

In April 2025, the revenues generated by the battery systems have dropped by 33% on average for all BESS durations compared to March 2025. This drop is mainly driven by an increase between March and April in the share of hydro to cover the demand. A decrease in gas usage over the past month has also been witnessed, coinciding with lower gas prices.

Overall, the aFRR average reservation prices have decreased from 34 € to 21 €/MW/h upwards, and from 29 to 20 €/MW/h downwards between March and April (a 36% decrease on average). The spreads on the mFRR service have also decreased by 33% and by 49% on the DA.

The index has been updated only until the 27th of April 2025 (last available data due to the Spanish blackout of April 28th).

Storage Index Poland:

With greater volatility on the DA due to solar production, ancillary services prices continue to increase, offering higher revenue opportunities for BESS systems than last month.

Storage Index Sweden:

This month, we have upgraded our data acquisition processes in light of data reporting issues in Mimer. Mimer was reporting mFRR energy prices only at a 1h timestep, even after the transition to 15min. This led to a 20% underreporting in the index for March 2025. Now, with more granular data, the index more closely represents the real revenue potential.

In comparison to March, April 2025 saw a significant decline in BESS revenues across different unit durations. The 1-hour and 4-hour BESS units experienced a 20% decrease, while the 2-hour BESS revenue fell more sharply, at 30%.

Although average mFRR up capacity reservation prices increased by 5%, average mFRR down capacity reservation prices plummeted by 56% compared to March. This substantial drop resulted in a 50% decline in mFRR capacity reservation revenues for 2-hour BESS units, reducing their share of total revenue from 80% in March to 54% in April.

Conversely, FCR products (FCR-N, FCR-D Up, FCR-D Down) saw an approximate 50% increase in average capacity reservation prices, causing their revenue contribution to grow significantly from just 3% to 24% for 2-hour BESS units.

On the trading side, Day-Ahead (DA) trading revenues improved by 45%, but this was offset by a 30% decrease in mFRR energy revenues from their March peak, resulting in an overall 18% reduction in trading revenues for 2-hour BESS units.

The Storage Index is calculated using COSMOS, Clean Horizon’s sophisticated energy storage simulation tool.

The Storage Index is available on our website here.