Previous

Previous

June 17, 2025

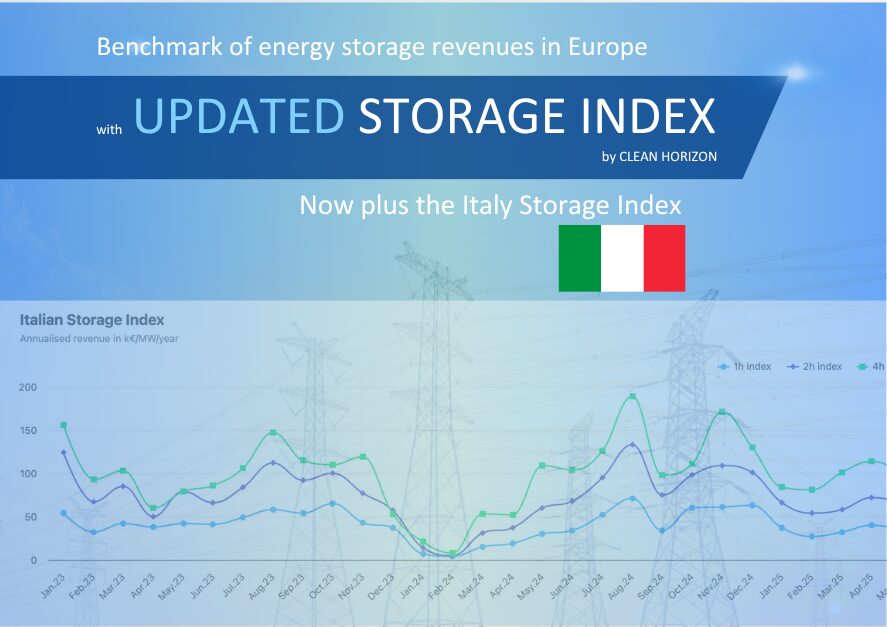

June 17, 2025 As promised, we’ve added one more country in this month’s Storage Index — welcome, Italy!

Below, you’ll find insights from our experts:

Available revenues for an energy storage system are notably lower than the remainder of covered countries. That is due to the limited number of accessible markets that mainly follow the volatility of the day-ahead market and no merchant mechanisms that value available capacity.

It should be noted that the index does not assume long-term revenues that are sourced from the capacity market auctions, the 2020 Fast Frequency Response one or the upcoming MACSE round – which would account for the bulk revenues of operational and under construction projects.

In May, the revenues increased mainly due to higher aFRR capacity prices. The aFRR capacity market prices are starting to present the usual summer spikes, driven by high renewable penetration and limited flexibility within the country. Imbalance and PICASSO prices remained stable. The revenues rose by 30% from April to May.

In May, BESS revenues in France saw a notable decline, primarily due to a sharp drop in aFRR prices, which were nearly halved compared to April. This brought them back in line with levels observed earlier in the year. In addition, market spreads narrowed compared to March and April, when higher renewable intermittency and overall market instability had created more favorable conditions for BESS revenue generation.

Revenues increased significantly across all markets, particularly in the FCR and aFRR energy segments. As a result, all battery sizes experienced a notable rise in earnings between April and May.

Despite a decline in primary reserve prices (FCR-N, FCR-D up, and FFR), higher prices on the mFRR capacity and aFRR energy markets enabled batteries in this zone to capture more revenues than in April.

In May, the BESS revenues have significantly declined with a decrease of 28% on average for all durations. This revenue diminution can be explained by the fall of prices and spreads on all markets and services. Prices on the aFRR reservation down have dropped by 18% and by almost half for aFRR up. The aFRR activation spread as well as the balancing spread have fallen by more than 30%. Finally, the spreads on the DA have also declined by more than 17%.

In May, prices for capacity reservation on both FCR and aFRR keep rising. The important increase in German solar generation drives the aFRR down auction prices up, benefiting 2h and 4h batteries, while 1h BESS revenue mainly increases because of higher FCR prices.

Due to a slight decrease in the capacity reservation charge prices, revenues have gone down a bit compared to last month. However, the average capacity reservation prices remain high (70€/MW/h UP + DOWN for aFRR and mFRR, and 40€/MW/h UP + DOWN for FCR), still offering great opportunities for storage projects.

The downward trend of revenues continued in May with the 2hr index reducing by 15% as compared to April. The mFRR activation revenue reduced by 60% but mFRR reservation revenue continued to dominate the revenue stack at 55% of the total.

Want to know more? Contact us and get more info about the Storage Index.

The Storage Index is calculated monthly and represents the annualised revenue of a storage asset based on the energy, capacity and ancillary services prices observed during that month. In other words, the calculated value assumes that the year consists of 12 repetitions of the same month; the Storage Index thus provides accurate information on how the specified month’s prices impact the revenue of a storage asset. Benchmark of energy storage revenues in Europe with the Storage Index