Previous

Previous

August 18, 2025

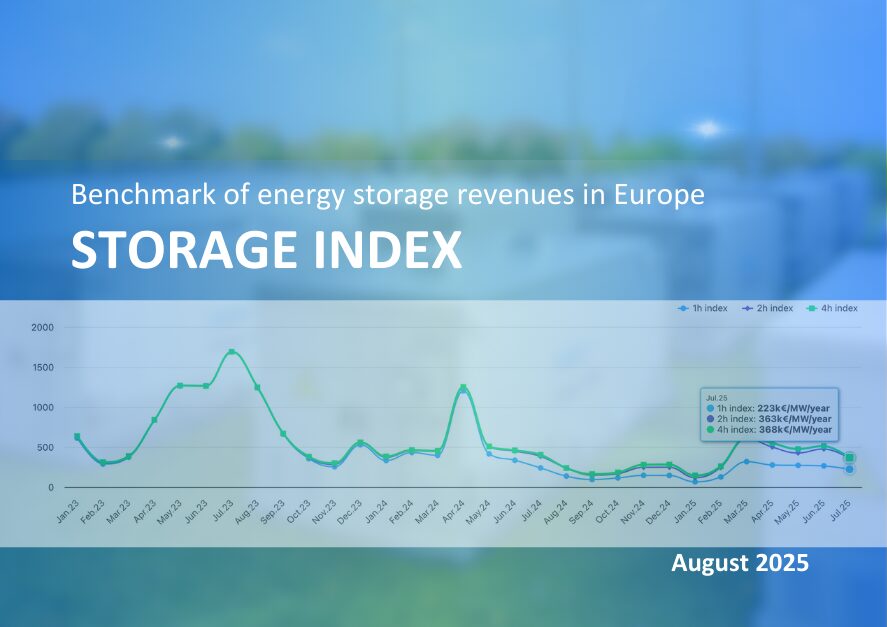

August 18, 2025 Each month, Clean Horizon publishes its Storage Index, tracking BESS revenues and market movements across Europe.

The Index provides investors, developers, and market participants with a reliable benchmark of how storage assets perform under changing conditions.

Below are insights from our experts on the latest market developments across Europe:

Following record-low revenues at the beginning of 2025, the Belgian aFRR capacity market has shown improved opportunities, particularly during weekends, with prices reaching up to €100/MW/h in both upward and downward directions. Meanwhile, aFRR activations and imbalance spreads have remained stable at around €400/MWh. These capacity price spikes have contributed to a 20% increase in revenues since July.

Revenues in DK1 slightly decreased due to maintenance on a 400 kV transmission line (see DK2), which limited capacity exchanges with DK2, particularly in the mFRR market. Additionally, lower FCR prices in July contributed to the observed revenue drop.

Maintenance on a 400 kV line near Copenhagen significantly restricted capacity exchanges, especially on the DK2–Sweden interconnection. As a result, batteries in DK2 were unable to provide aFRR capacity to Sweden. Demand therefore fell sharply, being limited to DK2 alone for this market, and prices dropped by 70% compared to June. The same trend was seen in FCR-N and FCR-D, where lower prices also had a substantial impact on battery revenues this month. The maintenance works are expected to last until 10 August.

In July, revenues declined across all BESS durations, primarily due to reduced trading income. Capacity reservation market prices dropped by 15%, with the most significant change seen in the mFRR down reservation, averaging 10.5€/MW/h this month. Additionally, spreads narrowed considerably, with a 19% decrease for aFRR energy and 34% for balancing energy. The day-ahead market followed the same trend. Notably, the number of hours with negative prices fell from 126 in June to just 20 in July.

In July, BESS revenues in France increased further +45% for the 2h battery, compared to what we have seen in June. The rise was primarily driven by sustained high aFRR prices. This growth occurred even as aFRR energy spreads continued to narrow due to RTE’s ability to activate lower-cost offers through PICASSO. In parallel, Day-Ahead market spreads widened compared to June, further supporting revenue growth.

While the last three months have been marked by significant volatility on the day-ahead market, with average daily spreads exceeding 150€/MWh and record negative hours, solar production stabilized in July and spreads began to decrease in July, reaching an average of 110€/MWh this month. The same trend can be observed for average reservation prices on the aFRR markets and marginal prices on the FCR market, which also fell from their three-month average of 20€/MW/h to around 15€/MW/h. Despite these declines, price levels remain high and would have enabled 2h and 4h BESS to capture more than 200k€/MW/year.

While the 1hr index has seen a marginal improvement, both the 2hr and 4hr indices have experienced a drop. This can be explained by the fact that DA, MSD and MB spreads have all reduced by 19-24% this month.

There is a drop in capacity reservation prices across the board in July. Notably all the down reservation prices have decreased roughly 50-60%, which also coincides with a drop in the share of renewables generation. Ultimately, that as lead to a nearly 30% fall in the 2hr index compared to last month.

In July, the BESS revenues have increased for all durations. This revenue augmentation can be explained by the increase on the aFRR reservation prices. Prices on the aFRR reservation up and down have risen by 40% and by 10% respectively. Thus, when considering symmetrical provision, the aFRR reservation prices have overall increased by 45% over the month of July. On the other hand, the aFRR activation spreads have decreased by 17% and as well as DA spreads by a similar percentage (20%). Finally, the balancing mechanism spread has increased by 2%.

There is a 24% drop in the 2hr index compared to the previous month. The mFRR reservation revenues continues to be the single largest source of revenue with its share increasing to 89% this month for the 2hr index. With a 33% drop in average FCR-N prices, its share in revenues reduces from 12% to 6%. FCR-D continues to have a negligible share in the revenues.

See the updated Storage Index here.

Contact us to learn more about the Premium Index and how it can support your business.