Previous

Previous

July 18, 2025

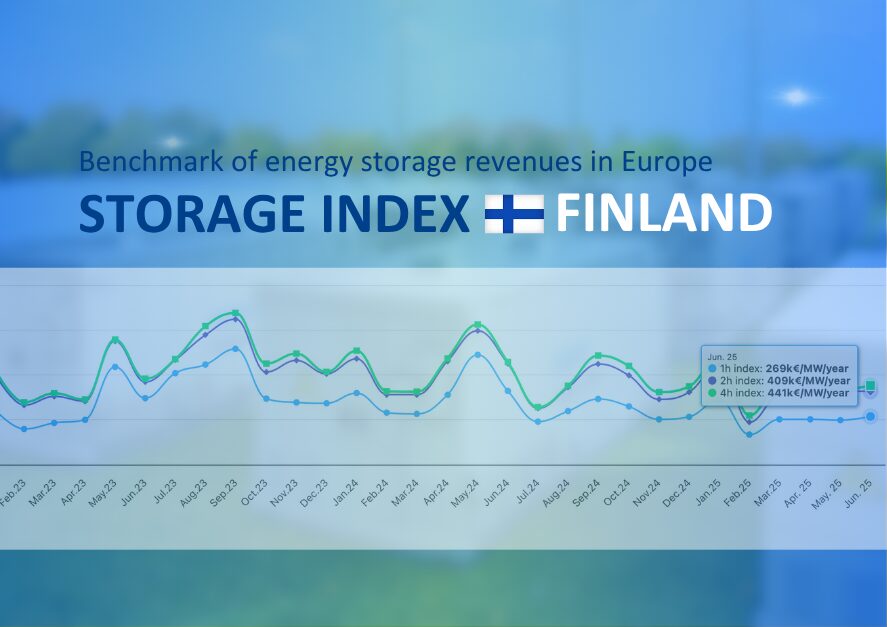

July 18, 2025 This month, Finland has been added to Clean Horizon’s Storage Index.

Below is the commentary from Clean Horizon experts on the Finnish energy storage market, based on insights from our Storage Index.

Since 2023, the Finnish electricity market has provided fertile ground for revenue generation. The wide range of capacity reservation markets, along with attractive spreads in the day-ahead and energy activation markets for secondary and tertiary reserves, has enabled batteries to achieve high profitability.

In 2023, the average ancillary market reservation price went from 15€/MW/h for mFRR upward reservation to 47€/MW/h for FCR-N reservation. At the same time, the day-ahead market showed significant spreads, averaging 133€/MWh in November. According to the Clean Horizon Index, revenues have been exceptionally high this year, with capacity reservation in the various FCR markets contributing the largest share.

In recent months, the Finnish market has undergone reorganisation, primarily to align with European platforms MARI and PICASSO. In June 2024, the aFRR energy market was launched, in preparation for the PICASSO go-live that occurred in March. Regarding the balancing market, the transition to a 15-minute clearing time for mFRR energy provision in March led to increased volatility (with an average daily spread of 836€/MWh since the change) and significantly affected imbalance prices, with very low-price events observed on the down-provision side immediately after the switch.

Over the past year, several major BESS projects have been commissioned, and nearly 400 MW are currently under construction. Since April 2025, the impact of battery-driven price cannibalisation has become evident in the FCR-N reserve market, where average prices have dropped from 46€/MW/h in 2024 to 19€/MW/h in June 2025. Nevertheless, the Clean Horizon Index has stabilised for the past three months at approximately 400k€/MW/year for a 2-hour battery, driven by large spreads in the balancing mechanism and the aFRR energy activation market, which also experienced record-high volatility (averaging 661€/MWh in June).

Contact us to learn more — and see the Storage Index here